A few weeks ago, someone I know—let’s call him Fred—found an inconspicuous letter buried in the mailroom of his co-working space. When he opened it, his heart sank; it was a notice from the IRS for nearly $20,000.

Fred’s business wasn’t even a year old. As the founder, Fred had been diligent in working with an accountant to file corporate taxes correctly and on time. He had personally set up their payroll vendor—a time-consuming process with a steep learning curve—and he had tried to stay on top of all the mail they received from various state agencies. How had he missed this?

While Fred is a fictional character, this story is 100% true—it’s mine.

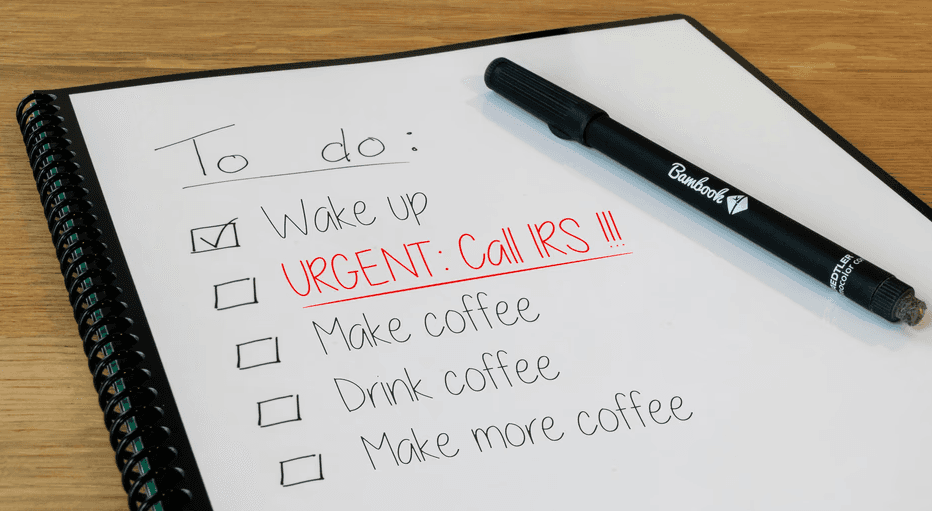

On top of being so high, the notice also stated that a 5% fine was being levied for every month they were late in paying—and the notice was from 3 months ago! The next two weeks involved countless and fractic hours of calling with our accountants, the IRS, the payroll vendor and going back-and-forth. Each day I’d have a high-priority action item related to figuring this out.

First I contacted our accountant, who clarified after two days that this was about payroll taxes, not corporate taxes. Now more confused, I called the IRS and, after an hour on hold, learned that my business owed payroll taxes for the last month of the prior year. But why would I owe payroll taxes when I had no employees at that time? The IRS agent suggested I check with our payroll vendor.

It took ten days to get through to our payroll vendor, who eventually responded saying they weren’t responsible. They told us to talk to our previous payroll provider. But we didn’t have a previous payroll provider 😱

Eventually - after several more days of trying - I reached the IRS again. This time, they said that the payroll vendor had sent our quarterly payroll filings twice. However, they could not find the duplicate notice. When I went back to the payroll provider, they denied that this had happened as well.

During this whole process I couldn’t help but think, I wish I had people who could take care of this for me. Even after I had gotten to the root of the problem, dealing with the IRS forms and resolution was time consuming and draining.

Incidentally, this experience led us to start dogfooding our own service - something we should have done much sooner. Now I have an internal HR expert - a DianaHR expert - handling all our back-office operations for us. It’s been a massive relief and has already saved me many hours.

I have seen many small business owners - across all different payroll and benefits vendors - get that “deer in the headlights” look when confronted with complex government notices. These founders are incredibly talented and hardworking, and their passion is to create businesses and take care of their employees - and I want to make sure they can do just that.

Stories like these are what inspired us to create DianaHR. We are HR & Ops for “pre-HR” companies. We handle everything from onboarding to offboarding to managing payroll to benefits to state registrations to workers compensation and more. And we make sure that you don’t ever have to be on call waiting with a government agency or customer support again.

Need help? Book time here for a call.

Share the Blog on: